Drops may be willing accomplices recruited online or unwitting individuals tricked into acting as recipients through fraudulent job postings or online scams. Once drops receive the items, they forward the goods to the criminals or reship them to another intermediary, further distancing the original perpetrators from direct involvement. Registration generally involves minimal personal information to maintain anonymity. Often, users create unique usernames and passwords, sometimes reinforced with encryption keys or PGP (Pretty Good Privacy) keys for secure communication. High-profile markets might also require verification steps to prevent law enforcement infiltration, such as referrals from established users.

Why Do Carders Use Bots To Conduct Carding Attacks?

Not all the above details are available for all 1.2 million records, but most entries seen by BleepingComputer contain over 70% of the data types. The freely circulating file contains a mix of “fresh” cards expiring between 2023 and 2026 from around the world, but most entries appear to be from the United States. Use this guide to learn how to easily automate supply chain risk reports with Chat GPT and news data. In the recent weeks, Cyberint has detected a rise in the dark web trade of ‘fullz’, for use in the fraudulent application of disaster loans.

The reputation and trustworthiness of an administrator are paramount, as they dictate the forum’s legitimacy and attract high-profile members. By observing how threat actors advertise and price different types of card data, we can identify which security measures they’re successfully bypassing and which ones are still effective. In this post, we’ll cover how credit card fraud operates on the dark web, how criminals obtain and trade card data, and cover some essential prevention strategies. Ultimately, successful future defense against carding will require collaborative efforts among financial institutions, technology providers, law enforcement agencies, and consumers. Public awareness campaigns emphasizing digital literacy, secure online behaviors, and recognizing emerging threats will play a crucial role in reducing vulnerability. Check your bank and credit card statements frequently—at least weekly—for unfamiliar transactions, even small ones, as criminals often test stolen cards with minor charges.

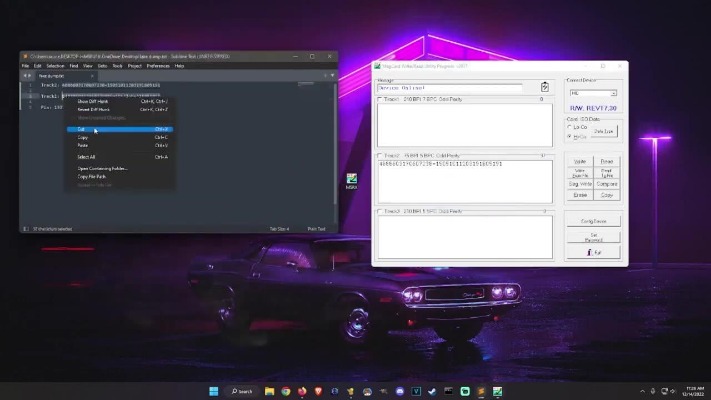

Card data on the dark web is a valuable commodity, and it’s often sold on specialized marketplaces known as Card Shops. These platforms are hubs for cybercriminals to buy and sell compromised payment card details. These platforms serve as hubs for cybercriminals to easily buy and sell compromised payment card details, including credit card numbers, CVV codes, expiry dates, and cardholder information. Carding forums are often hidden using TOR routing, and payments made for stolen credit card data are performed using cryptocurrency to avoid tracking by the authorities. By delving into the inner workings and structure of carding forums, we gain insight into the complex ecosystem that fuels cybercrime on the dark web.

Recognize Signs Of Credit Card Compromise

Under the Fair Credit Billing Act, cardholders are liable for no more than $50 in unauthorized charges, meaning the direct financial impact of falling victim to a carding scheme is unlikely to be significant. The Cyberint Research Team work round the clock to unearth the latest threats to SMBs and enterprises. They are on top of the latest TTPs and monitor rising threat groups, malwares and trends. However, they can inconvenience real users and work against your efforts to increase conversion rates. A recent study on the checkout experience found 29% of real users fail CAPTCHAs.

Some users are in the forums trying to engage in smear campaigns against the competing forums. It’s a platform for both beginners and elite hackers where they share knowledge on a wide range of topics like carding and advanced hacking techniques. The information shared on this platform is designed to keep out any curious or inexperienced actors. Therefore, it’s considered not only legitimate but also highly valuable to those who are part of this notorious forum. Carding activities cause substantial financial losses to individuals and businesses, leading to increased costs and potential bankruptcy. As mobile payments become more popular, carders have shifted their focus to exploiting vulnerabilities in mobile payment systems.

Responsibility Of Businesses To Prevent Carding

Digital Shadows says messaging platforms like Telegram and Discord are where some of the actual trading now occurs. Some of the remaining dark web forums are used “solely for marketing purposes or to swap information about the best platforms on which to buy carding-related data,” according to researchers. As the name suggests, it’s a dark web carding forum made primarily to “sell” products and services. This forum is actually attached to the Topsells market and is also used to discuss problems/reviews about orders. Throughadvanced tooling and techniques, such as the “Ghost Tap”method and remote transaction relays, they can bypass detectionsystems and cause significant financial damage to victims. The globalnature of NFC payments and the anonymity provided by money mules andencrypted communication channels make these fraud operationschallenging to track and shut down.

Agentic AI In Cybersecurity: Transforming Threat Detection And Defense

- The merchant is liable for contactless transactions above the CVM limit that have no cardholder verification.

- Carding bots have automated the card testing and validation process, allowing fraudulent actors to scale their operations and commit fraud faster.

- However, thetechnology behind NFC (Near Field Communication) has been aroundsince the early 2000s, with the first NFC-enabled phone launched byNokia in 2006.

- Dark web monitoring platforms, such as Lunar, provide an automated solution to safeguard personal identifiable information (PII) and credit card details.

- Based on the analysis of the posts, Chinese cybercriminals target the US, Australia, Canada, Japan, the UK, Malaysia, and Taiwan, along with African countries, as their main priority for conducting fraud.

This allows it to respond to APDU command sequences just like a real card would. The payloads it handles are likely customizable, enabling users to define specific NFC responses — a capability that could potentially be used to spoof identity-based card systems. Some vendors offer a “complete package” known as “Fullz”, which includes full personal details as well as financial details like bank account information or social security numbers. These checkers are often offered and sold on the dark web, and are complimentary tools that individuals and organizations use to verify credit card information. Stolen card details often end up on the dark web marketplace for a quick profit, and this can happen before you even know about it.

We’ll explore how credit card data is stolen, the workings of illicit marketplaces, and the processes criminals follow from acquiring data to converting it into profit. Additionally, we’ll discuss the risks users face when their financial information is compromised and provide actionable guidance on protecting yourself against becoming a victim. By shedding light on these hidden online networks, you will better understand the threats that exist in cyberspace and how proactive awareness can significantly reduce personal and collective risk.

Disrupting Dark Web Carding Operations

By understanding these prevalent methods of credit card theft, individuals can proactively identify risks, enhance their security practices, and significantly reduce the likelihood of becoming victims of fraud. Even highly secure financial institutions and payment processors are vulnerable to data breaches. Criminal groups often target these entities because of the volume and quality of available data. For example, the 2021 data breach of Experian, a major credit bureau, exposed sensitive personal and financial information of tens of millions of customers, underscoring the persistent threat of large-scale leaks.

Top 10 Dark Web And Deep Web Forums Of 2025

Sometimes hackers will commit “card-present fraud” by breaching the point of the sale at a physical store. Or they’ll commit “card-not-present fraud,” by hacking a website and stealing the online card information that gets entered into the checkout page. It’s also the latest in a growing list of criminal marketplaces to have voluntarily closed shop over the past year, including that of White House Market, Cannazon, and Torrez.

Use Trusted Websites

These tools include for example different types of checkers, which assist threat actors in verifying whether the stolen card information they possess is valid and can be used to make unauthorized purchases. It involves using stolen credit card information for fraudulent purchases, which makes it an example of both identity theft and financial fraud, both of which can carry serious legal consequences. Among these threats is carding, a type of fraud used by cybercriminals to profit from stolen credit card information.

Illicit Services

They started to design new techniques and tools toleverage NFC and mobile wallets to perform illegal transactions andsteal money from victims. According to a blog by SOCRadar, the release of such comprehensive data poses significant risks, including financial fraud and identity theft. This data enables cybercriminals to commit fraud, resell stolen credentials, and facilitate identity theft. Card Shops typically host the trade of credit cards and other stolen financial information, making it easy for cybercriminals to find what they’re looking for. Leaked credit cards from Telegram channels account for the overwhelming majority of compromised payment card details. The constant battle between carders and law enforcement is akin to a game of cat and mouse, with each side constantly adapting and strategizing to outwit the other.

Malware And Spyware

The cards are then used by criminal actors to purchase high-value items or gift cards. It has built a reputation for being a reliable source of stolen credit card data and PII. Renowned for its extensive inventory of financial data and sophisticated operating methods, Brian’s Club is a key player in the underground economy of financial cybercrime. Known for its vast user base and extensive range of illicit content, Nulled is a hub for cybercriminal activities, including the exchange of stolen data, hacking tools, and cracked software. Despite significant disruptions, including a major hack in 2016, Nulled has maintained its status as a key player in the cybercriminal ecosystem.

The use of cryptocurrency on dark web marketplaces has further facilitated carding operations. Cryptocurrencies such as Bitcoin and Monero provide a level of anonymity, making it difficult to track transactions. While cybercriminals have become increasingly sophisticated with their attacks, many online retailers have not followed suit, continuing to rely on traditional or ineffective security tactics. Many sites attempt to block bot attacks simply by adopting CAPTCHA methods, but CAPTCHAs often frustrate real users and drive abandonment. The carder authenticates card numbers en masse by deploying a bot network to attempt small purchases on multiple online payment sites. The bots will plug in different combinations of credit card numbers, expiration dates, and CVV codes until a transaction goes through.